does nc have sales tax on food

For a detailed list of taxable services download this. North Carolinas general state sales tax rate is 475 percent.

North Carolina So Increase Tax On Bread Avalara

In North Carolina as in other states diners face a patchwork of sales taxes.

. 35 rows 7. However items that qualify as food under the provisions of the Federal Food Stamp Program are taxed at a lower. The Article 43 half-cent Transit.

Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Some services in North Carolina are subject to sales tax. Does North Carolina have food tax.

Prepared food and soft drinks from restaurants and bars are taxed at the 475 General State rate and applicable local rate and transit rates of sales and tax. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the. Prepared Food is subject to a higher state sales tax then other items.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Missouri requires sales tax on food and food-related items. 53 rows Table 1.

Three states Alabama Mississippi and South Dakota continue to apply their sales tax fully to food purchased for home consumption without providing any offset for low-. Like most states there are goods exempt from the tax in North Carolina like food thats not prepackaged or served for consumption on site. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

Some examples of items that exempt from North. A rate schedule was also established reducing sales tax on electricity sold to. This page describes the.

Prescription Medicine groceries and gasoline are all tax-exempt. The transit and other local rates do not apply to qualifying. State Sales Tax The North Carolina state legislature levies a 475 percent general sales tax on most.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. In the state of North Carolina any and all sales of food are considered to be subject to local taxes. The average effective property tax rate in North Carolina is 077 well under the national average of 107.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes. What is NC sales. The NC sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction.

In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer. 35 rows Sales and Use Tax Rates. Certain items have a 7-percent combined general rate and some items have a miscellaneous rate.

But North Carolina does charge the. A 200 local rate of sales or.

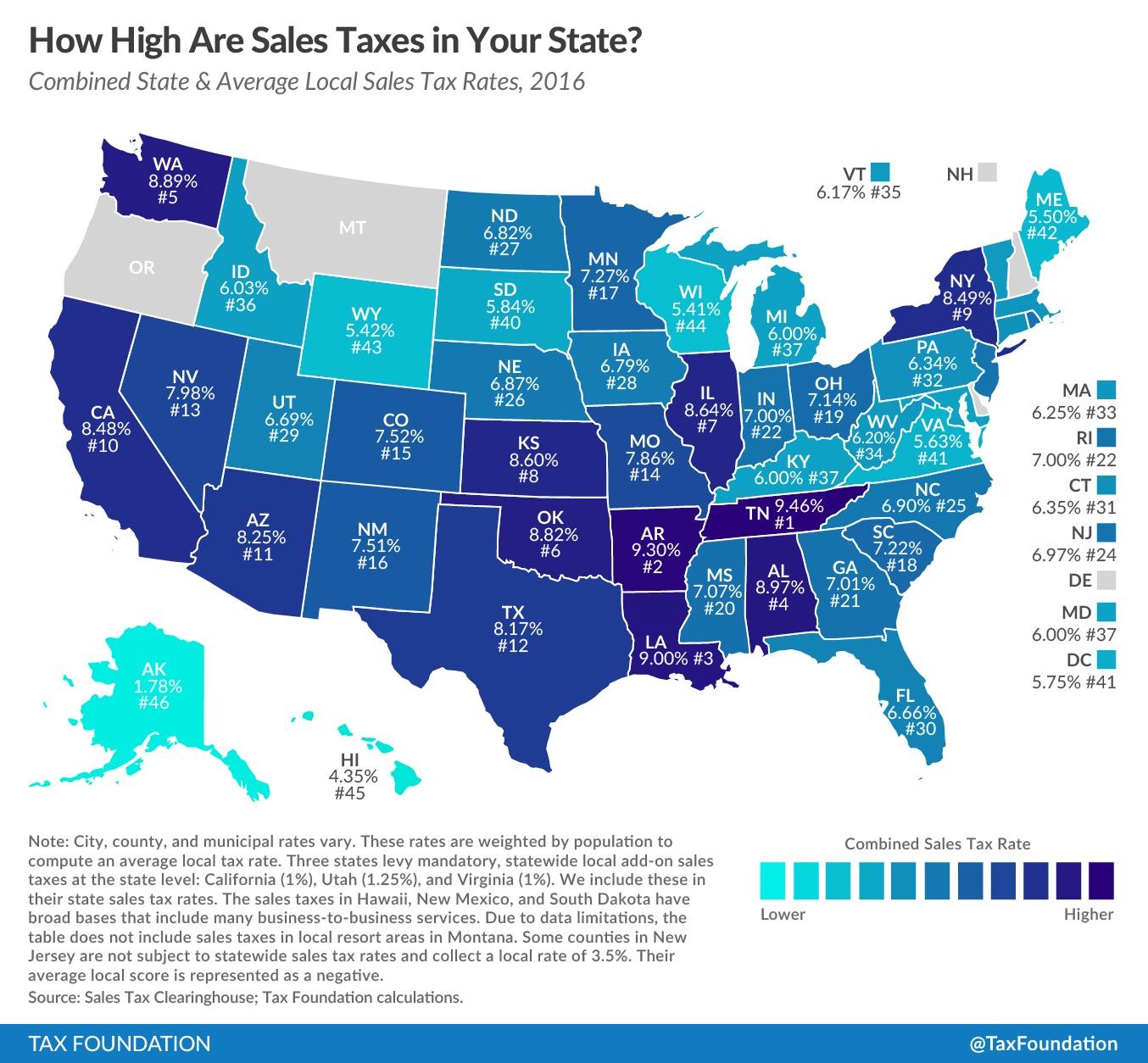

State And Local Sales Tax Rates In 2016 Tax Foundation

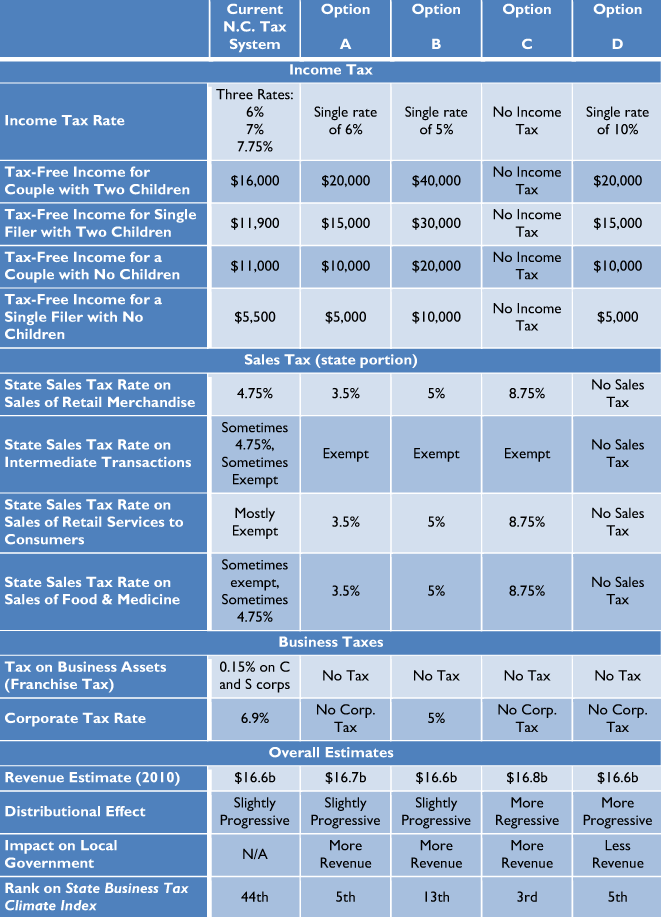

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

States With The Highest Lowest Tax Rates

New Jersey Sales Tax On Restaurants Sales Tax Helper

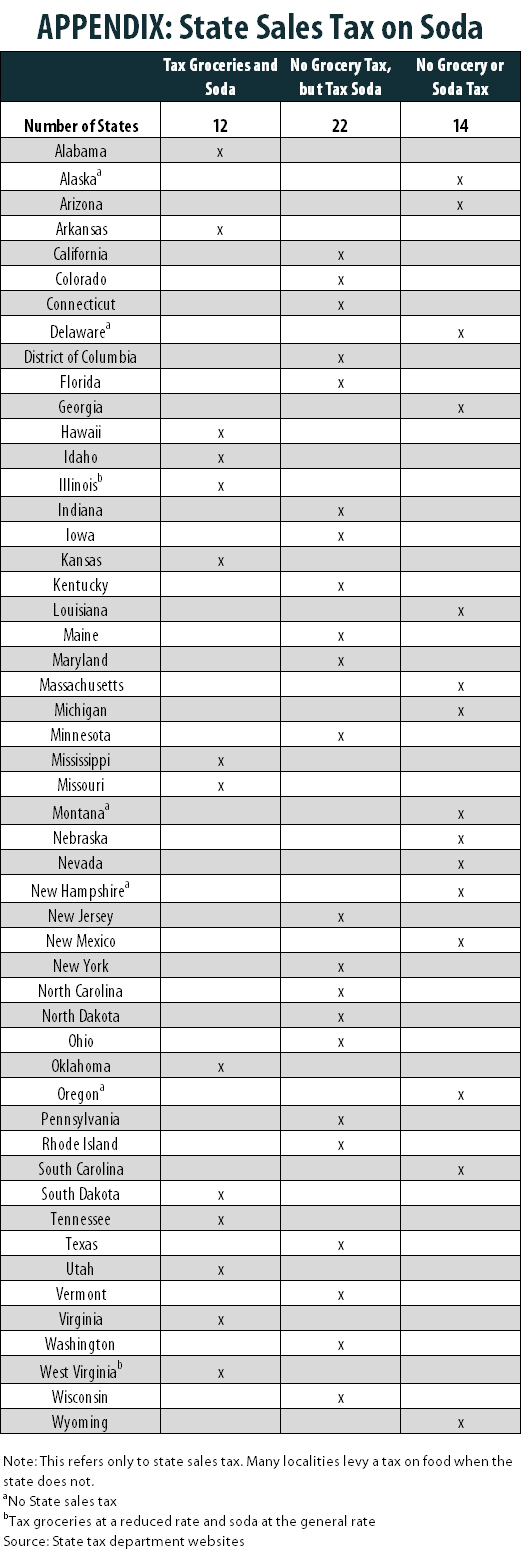

How Are Groceries Candy And Soda Taxed In Your State

Monthly Tax Credits End Leaving Some Nc Families Forced To Make Cuts Abc11 Raleigh Durham

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How To File And Pay Sales Tax In North Carolina Taxvalet

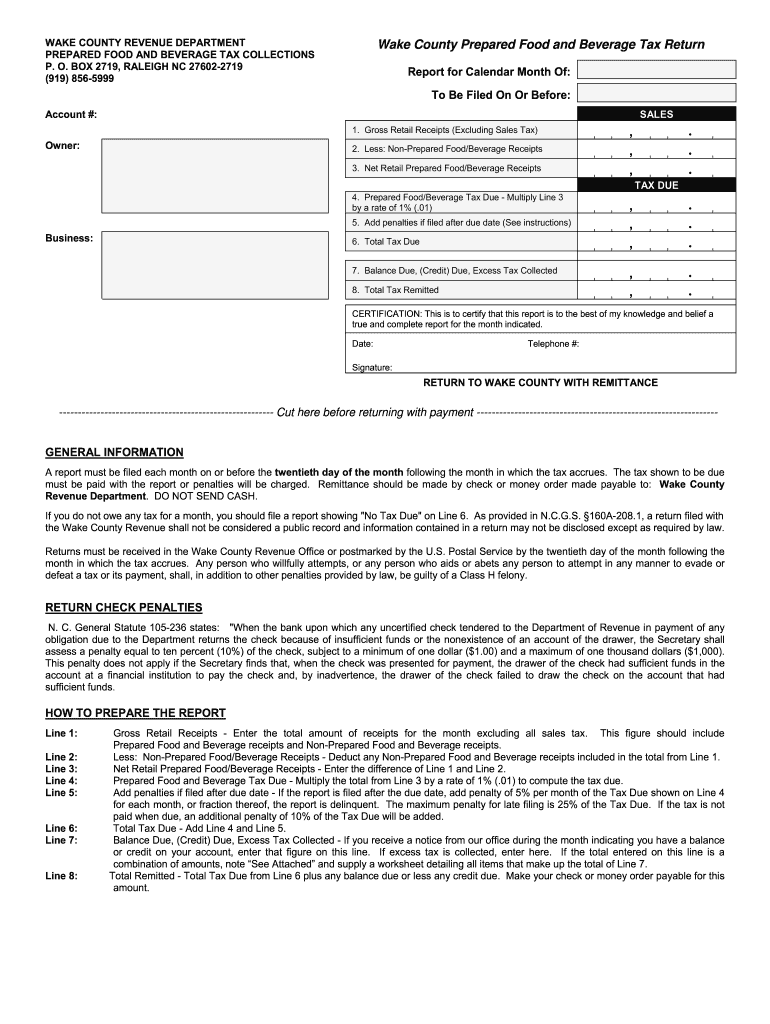

Wake County Prepared Food And Beverage Tax Return Fill And Sign Printable Template Online Us Legal Forms

Sales Tax By State To Go Restaurant Orders Taxjar

4 Ways To Calculate Sales Tax Wikihow

Sales Taxes In The United States Wikipedia

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Kansas Gov Laura Kelly And Gop Challenger Derek Schmidt Both Propose Cutting The Sales Tax On Groceries Kcur 89 3 Npr In Kansas City

The Short And Sweet On Taxing Soda Itep

Exemptions From The North Carolina Sales Tax